Target Online Tax Exempt

The plaintiffs in the Target case pointed to Regulation 6359 of the California Sales and Use Tax Law which exempts from sales tax food products for human consumption including coffee and coffee substitutes tea and cocoa and cocoa products They alleged that Target had charged them sales tax on their purchases of hot coffee to go and thus caused plaintiffs to suffer monetary loss They later added that Target. I did not have a tax-exempt account at the time of purchase.

Data Center Sales Tax Exemption Program Department Of Economic Development

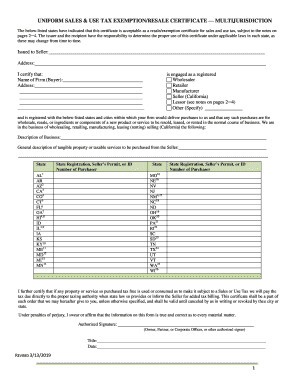

Please note any incomplete information on your exemption document signature date not checking every applicable box will result in a request for.

Target online tax exempt. Does my Best Buy Tax Exempt Customer Account expire. Tax exemption certificates requirements include. Sicherlich kennen Sie das Problem dass B2B-Kunden in anderen EU-Lndern ohne Mehrwertsteuer kaufen knnen oder.

Target also appears to be um targeting. If you use a resale certificate to purchase an item but do not end up selling it your state requires that you pay consumer use tax on the taxable item. To the cashier before scanning her groceries.

Tax Exempt Manager funktioniert sowohl mit Netto-Preisen als auch mit Brutto-Preisen. No Na. Things reportedly changed after a May 12 memo which instructed employees not to allow customers with tax exempt IDs to make purchases.

If you are planning on making purchases in-store then your tax exempt. LatoriApps Tax Exempt Manager untersttzt Sie bei der Einhaltung der EU-Richtlinien. New comments cannot be posted and votes cannot be cast.

Applying for Tax Exempt Status. The local team enjoys hearing how our giving programs help in their community. If you would like to set up multiple users please submit all of the required information below for each individual user.

Can I get a refund for previous purchases. Once you have followed the steps outlined on this page you will need to determine what type of tax-exempt status you want. Target for example is known for attempting to curb online competition by refusing resale certificates from any suspected reseller.

If your Target-funded program requires a program evaluation Target will send an online link with instructions. Yes To receive a refund for tax paid on exempt purchases please contact us at 1-800-591-3869. Level 1 5y.

Certificate organization name should align with Pearson account name. Shit not a single store I buy from is tax exempt. If approved you will be eligible to make tax-exempt purchases immediately.

For more information please refer to the. Refund details can be found on the Tax Information page. Proof of exemption in PNG JPG or PDF format for the states where the items will be shipped.

Follow the steps here to sign-up. Mit dem Tax Exempt Manager EU-weit punkten. Tax exempt at Target.

Perhaps looks for items with higher margins. 11-232 and 11-236 of the Tax General Article of the Maryland Annotated Code permit an exemption from sales and use tax on certain construction materials and warehousing equipment for use in certain areas. Your status will show.

Free 2-day shipping on eligible items with 35 orders REDcard - save 5 free shipping on most items see details Registry. Your Tax Exempt Customer. Tax Exemption submissions can be sent via email fax or webform.

As of January 31 the IRS requires that Form 1023 applications for recognition of exemption be submitted electronically online at wwwpaygov. The name on the exemption form must match the Pearson Account name used for delivery. If youd like to send a thank you note please send it to your local Target Store attention of the Store Team Leader store manager.

If you have any questions or need additional assistance contact Amanda Robinson in the Tax Office at 8-4817 or. You will receive confirmation that your tax-exempt number was applied and will also be presented with the option to remove the tax exemption. If youre picking product up or shipping product to a state where youre currently not registered as tax exempt youll be charged tax.

To check the status of your application click on Tax-Exempt Program and then click Tax-Exempt Application. Food for human consumption is exempt. I liked going in and dumping 5k into target inventory tax-free.

Cashier nods and says ok. If you want to set up a tax exempt account with us for online purchases you would need to call our online team at 614-850-3675 option 3. In Progress or Accepted or Rejected.

If the name does not match a letter explaining the relationship is required. This thread is archived. Machen Sie Ihren Shop nach EU-Recht verkaufsbereit.

- Lady in front of me at Target says Im tax exempt. Look at all that business you are losing now. If youre tax exempt in multiple states you can update your tax-exempt status through your.

Target redevelopment areas in Baltimore County that were previously owned by Bethlehem Steel Corporation or any of its subsidiaries and are participating in. There is no need to proactively reach out for the evaluation. Please note it may take up to 2 business days for your status to be approved or denied.

The hours are 10am to 5pm EST Monday through Saturday. Tax is calculated based on the final destination of the product.

Anti Base Erosion Provisions And Territorial Tax Systems In Oecd

Florida Tax Free Week Is Bigger Than Ever In 2021 Blackfriday Com

Tax Exempt Certificate Fill Out And Sign Printable Pdf Template Signnow

Dropshipping Taxes Everything You Need To Know As Beginner

These 15 States Are Having A Back To School Tax Free Weekend The Krazy Coupon Lady

New Therapeutic Target In Heart Failure Circulation

Govt To Facilitate Remittances Through Tax Exemptions Newspaper Dawn Com

Https Www Mdpi Com 2071 1050 13 5 2719 Pdf

These 15 States Are Having A Back To School Tax Free Weekend The Krazy Coupon Lady

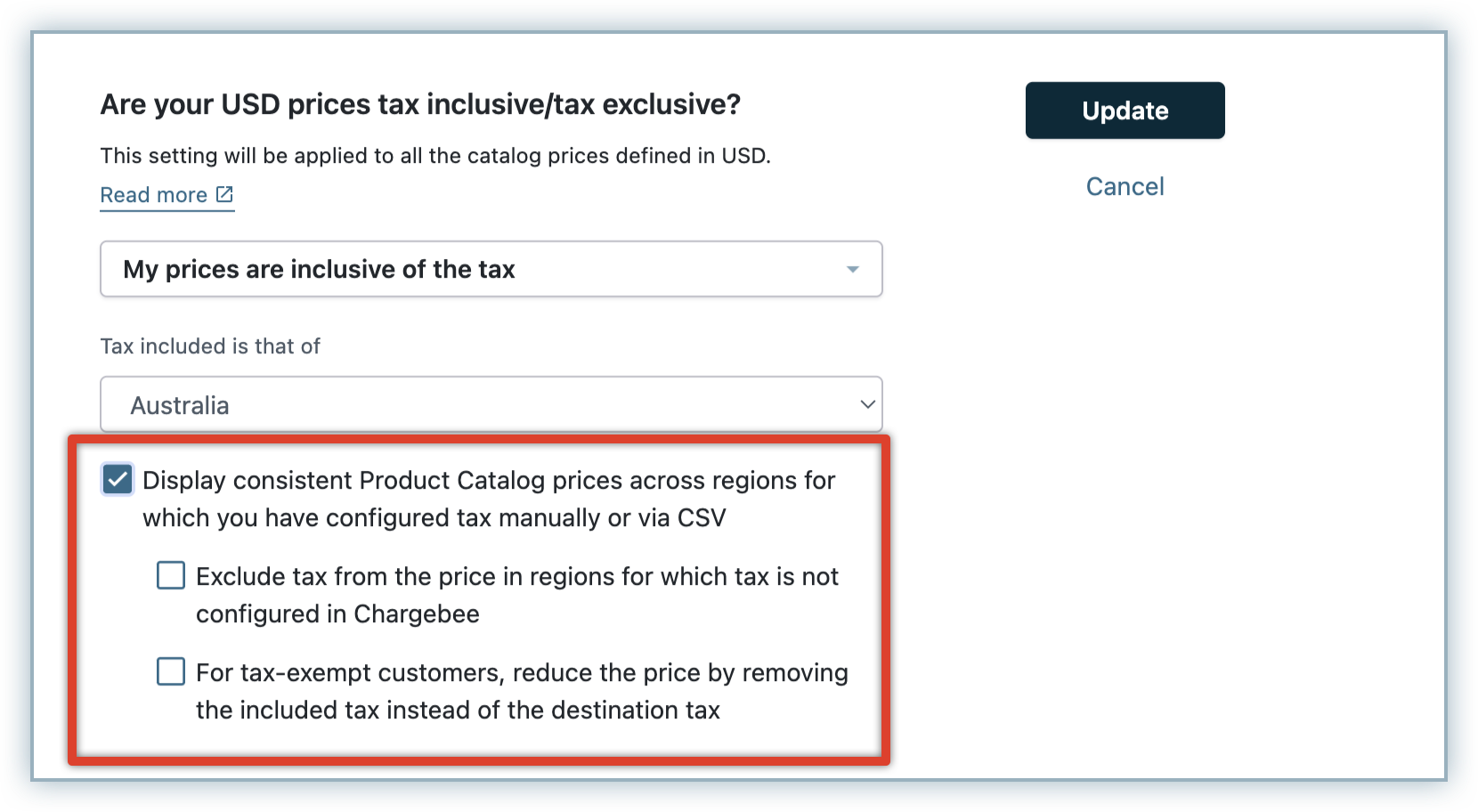

Configuring Taxes Chargebee Docs

Configuring Taxes Chargebee Docs

Tips For Buying Tax Exempt Textbooks Textbook Tax Tips

Virginia S Tax Free Weekend 2021

These 15 States Are Having A Back To School Tax Free Weekend The Krazy Coupon Lady

How To Apply For Tax Exemption In The Philippines

Germany Tax Developments In Response To Covid 19 Kpmg Global

States With Highest And Lowest Sales Tax Rates

501 C 3 Vs 501 C 4 Key Differences And Insights For Nonprofits

Chapter 100 Sales Tax Exemption Personal Property Department Of Economic Development

Post a Comment for "Target Online Tax Exempt"